投資収益率は、投資の収益性の尺度です。 通常、パーセンテージで表され、損益(純利益)を初期投資コストで割って計算されます。 ROIは、投資の効率性を評価するための重要な指標であり、投資家がどの投資を行うかを決定する際の指針としても役立ちます。

良いROIとは?

良いROIは、測定される投資の種類に依存します。 一般的に、ROIが高いほど良く、ROIが低いと不採算な投資を示します。 例えば、株式市場投資の典型的なROIは10-20%の範囲ですが、不動産投資のROIは5-15%の範囲です。

ROIはどのように計算するか?

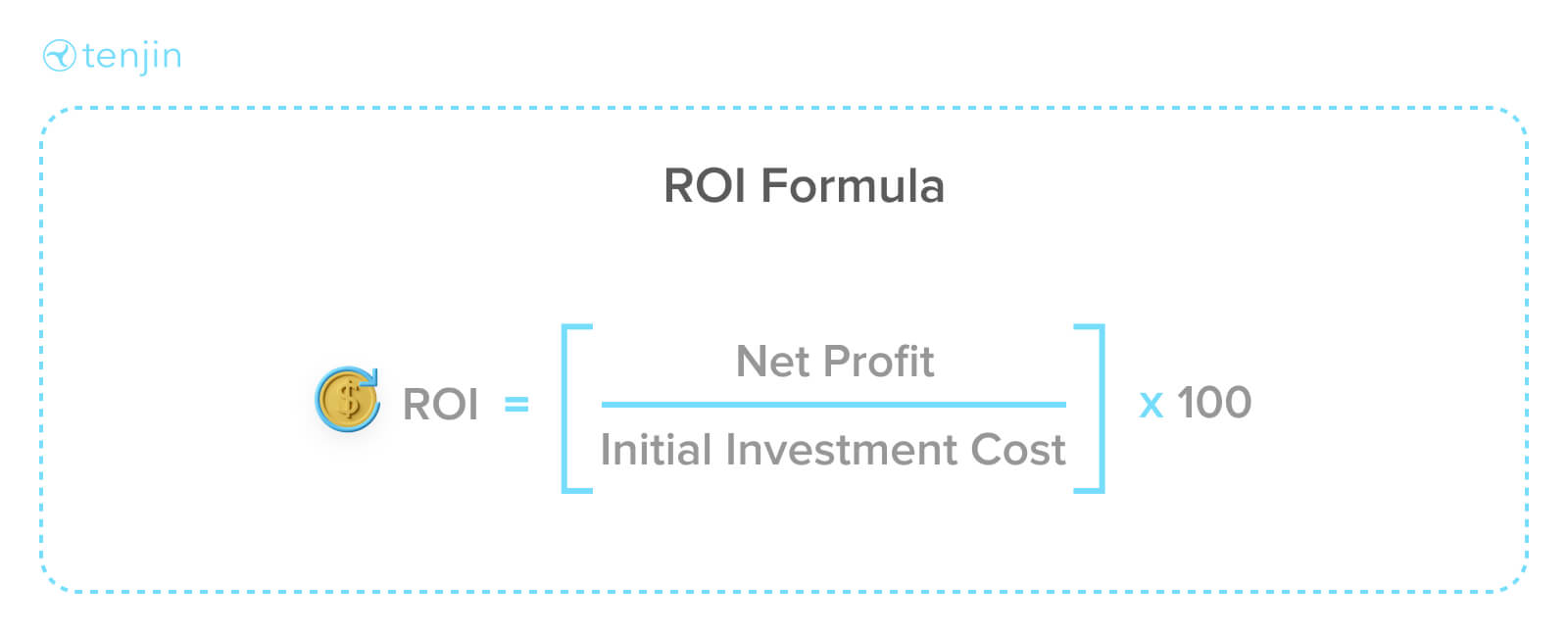

ROIは、投資の純利益を初期投資コストで割って算出される。計算式は以下の通り:

ROI = (純利益÷初期投資コスト) x 100

例えば、ある投資家が株式投資に500ドルを費やし、1年後に純利益が750ドルになった場合、ROIは以下のように計算される:

ROI = ($750 / $500) x 100

ROI = 150%

TenjinでのROIの計算方法は?

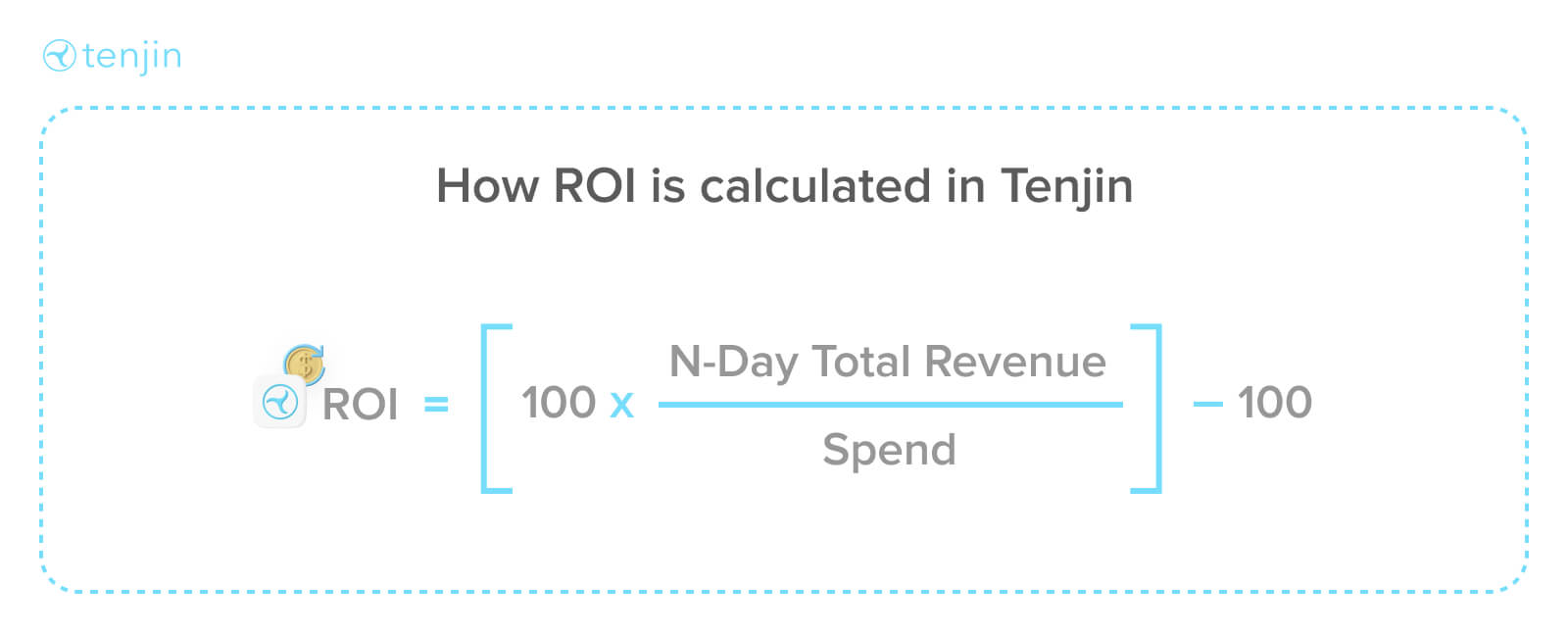

平均N-Day ROIパーセンテージは、累積総利益(導入後N日間の総収入-支出額)を支出額で割って計算されます。

TenjinのダッシュボードにはどのようなROI指標がありますか?

TenjinダッシュボードのROIメトリクスの全リストとその説明はこちらをご覧ください。

ROIを計算する利点とは?

ROIの計算は、投資家が投資の効率を判断するのに役立ち、どの投資を行うかを決める際の指針となる。投資家はROIを使ってさまざまな投資オプションを比較し、最も高いリターンが期待できるものを選ぶことができます。さらに、ROIは投資家が長期にわたって投資のパフォーマンスを追跡し、改善すべき分野を特定するのに役立ちます。

ROI計算の限界とは?

ROI計算の主な限界の一つは、貨幣の時間的価値を考慮していないことです。つまり、ROIは投資がリターンを生むまでにかかる時間の長さを考慮していません。さらに、ROIは取引コストや市場のボラティリティなど、関連するコストやリスクを考慮に入れていません。そのため、ROIは投資を評価する際の数ある指標の一つとして使用されるべきです。

生涯IAP ROIとは?

生涯IAP ROIとは、ユーザーの生涯にわたってアプリ内課金(IAP)が生み出す投資収益率(ROI)のことです。この指標は、アプリの長期的な収益性を測定するために使用され、アプリ開発者が長期的なユーザーの価値を理解するのに役立ちます。

生涯IAP ROIは、ユーザーが初めてアプリをダウンロードしてから使用を停止するまでに行われたすべてのIAPを考慮に入れます。ユーザーのIAPによって生み出された総収入を計算し、そのユーザーを獲得し維持するコストで割ることで、アプリ開発者はそのユーザーの生涯価値を決定することができます。

生涯IAP ROIを測定することで、アプリ開発者は自社のビジネスにとって最も価値のあるユーザーを特定し、それに応じてユーザー獲得・維持戦略を最適化することができます。価値の高いユーザーの獲得と維持に注力することで、アプリ開発者はアプリの長期的な収益性を最大化することができます。

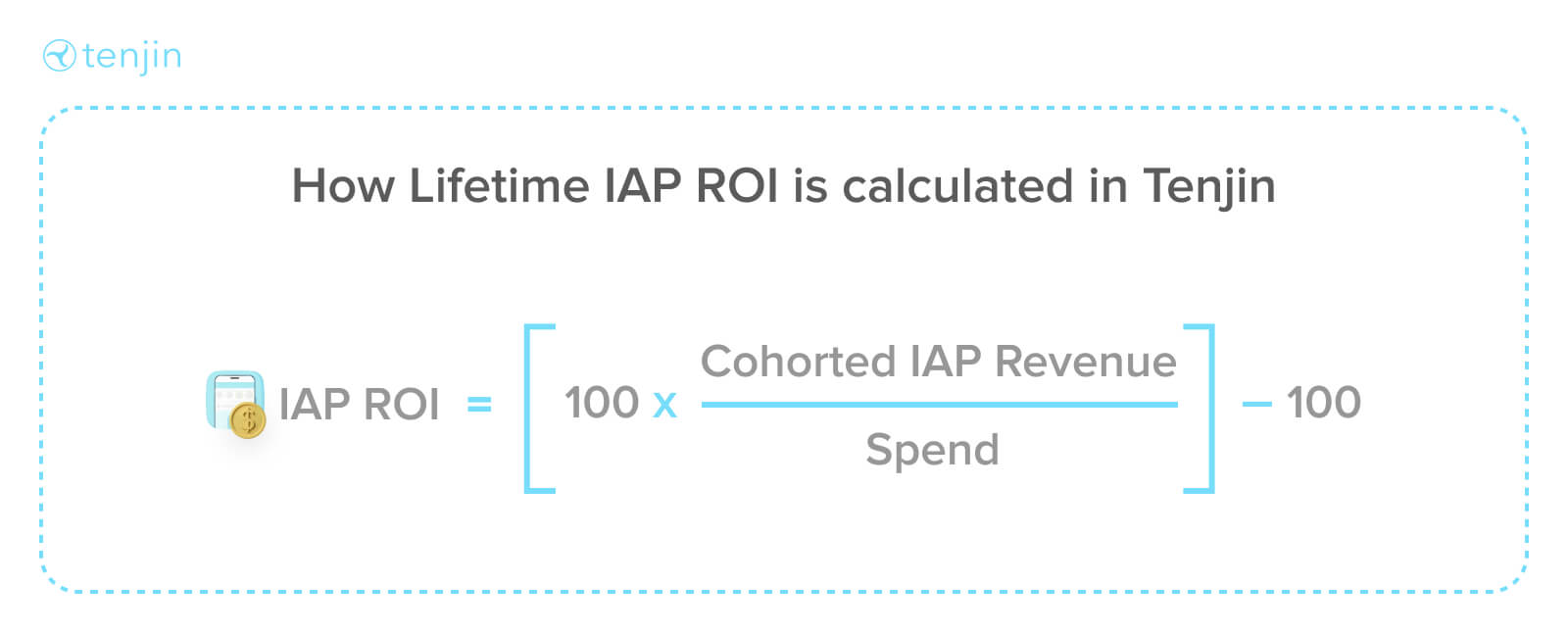

Tenjinでは、Lifetime IAP ROIは、ある日付範囲のIAP ROIをコホート化したもので、以下の計算式で算出されます:

生涯広告ROIとは?

生涯広告ROI(投資利益率)は、ユーザーの生涯にわたって広告キャンペーンによって生み出された総価値を測定するために使用される指標です。この指標は、広告キャンペーンによって獲得されたユーザーによって生み出されたすべての収益を考慮したもので、初回購入とその後の長期にわたる購入の両方を含みます。

生涯広告のROIを計算するには、広告キャンペーンを通じて獲得したユーザーによって生み出された総収入をキャンペーンの総費用で割ります。結果は、広告キャンペーンの投資収益率を示す比率となります。

例えば、ある広告キャンペーンに1万ドルの費用がかかり、キャンペーンを通じて獲得したユーザーから5万ドルの収益を上げた場合、生涯広告ROIは5(すなわち、5万ドルの収益÷1万ドルの費用)となる。

生涯広告ROIの測定は、広告主が広告キャンペーンの長期的な影響を理解し、それに応じてマーケティング戦略を最適化するのに役立ちます。生涯価値の高いユーザーの獲得に注力することで、広告主は広告投資のリターンを最大化し、キャンペーン全体のパフォーマンスを向上させることができます。

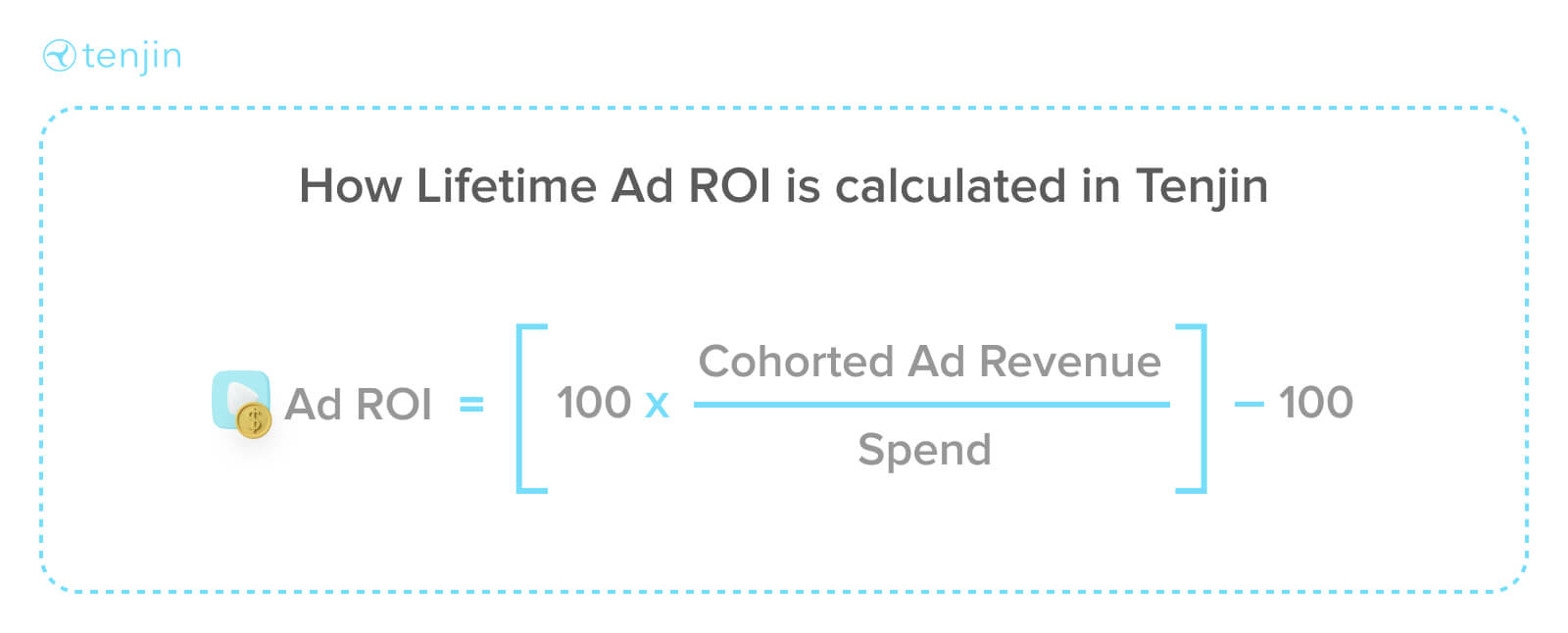

Tenjinでは、ライフタイム広告ROIは平均広告ROIパーセンテージを表し、以下の計算式で算出される: